What is a Credit Score?

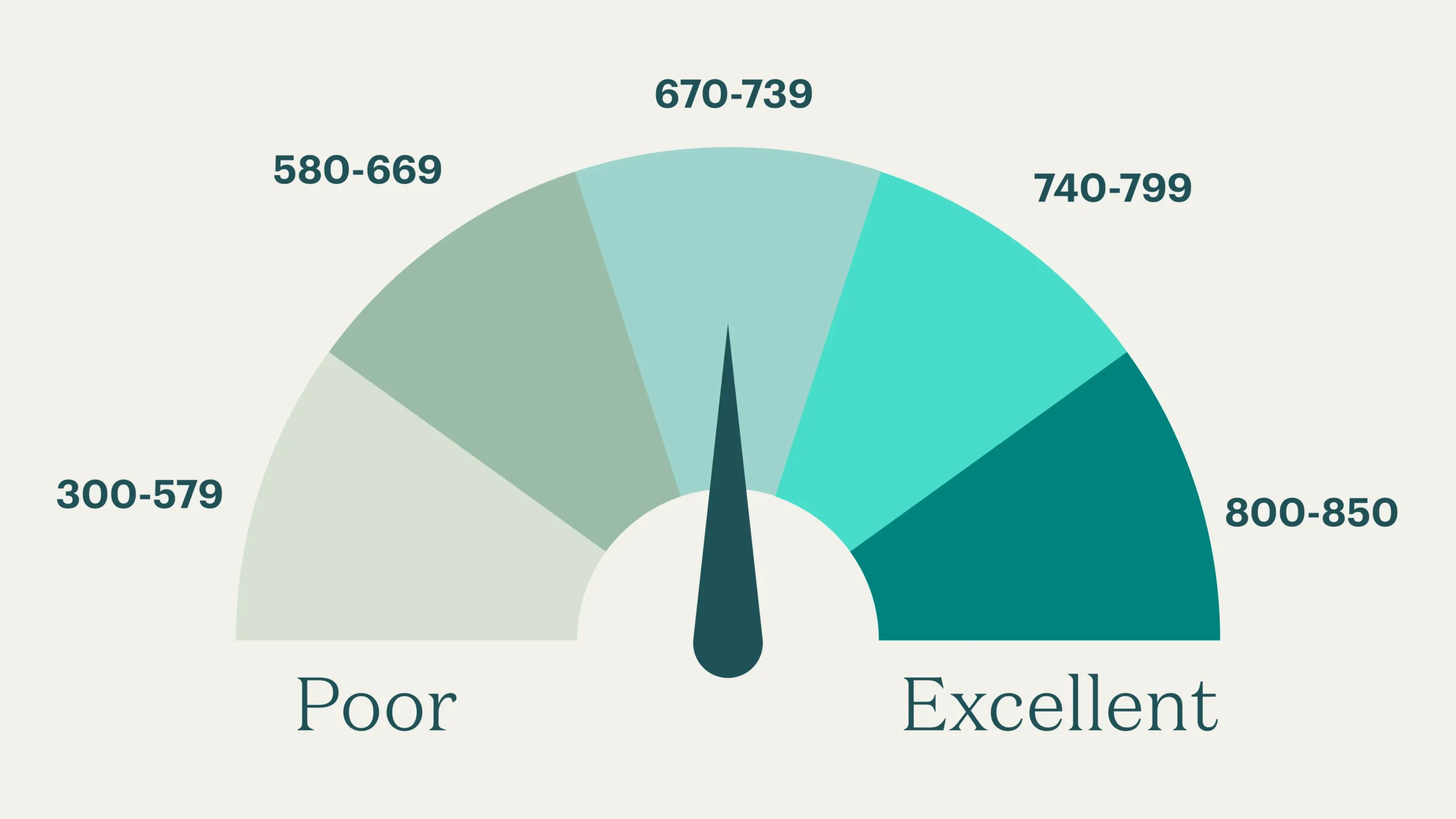

A credit score is a numerical representation of credit level and worthiness. It is usually scaled between 300 and 850 points. Different factors can either positively or negatively impact credit scores, such as credit utilization, type diversification, on-time payments, and debt repayments. You can check your credit score through various online platforms like Credit Karma, Experian, or TransUnion. These platforms offer free access to your score annually or at more frequency with registered accounts but guess what, there is also a way for a free credit scores check you can also request a free credit scores report from AnnualCreditReport.com, which is authorized by the U.S. government.

How to improve credit score?

Here’s a summary of each heading in the guide on improving credit score:

1. On-Time Payments

It is always prescribed to pay within the deadline, and on-time payment is the most significant factor in your credit scores. A payment history has a track record of all on-time, late, or missed payments. Late and missed payments mainly have a negative impact on your credit score. If you pay bills on time, your credit score will be raised.

2. Paying back debts

If you pay down debts on top priority, this will have a positive and feasible impact on your credit scores as it impacts 30% on your score. Set a target to lower credit utilization as much as possible. Paying down debt on time will not only ease your burden and save you from interest but it will positively impact your credit score, showing you results in a few months.

3. Utilize the merits of having an old account

Your score is 15% affected by the length of your credit scores. Go for maintaining your credit history and avoid closing old accounts, especially credit cards. If you are keeping old accounts, then it could be more beneficial to upgrade them timely. This will help you preserve your score. Negative effects could appear fast, though, if you close an existing account or open several new credit accounts in a short amount of time.

4. Credit diversification

Using credit cards of different varieties can be a good idea. Credit combo on the basis of types affect 10% of your credit scores positively. Considering different types of credit such as (e.g. good travel credit cards, interest-free credit cards, or credit visa cards, etc.) will improve your credit scores but the mistake to avoid is taking too much unnecessary debt just for diversity. But make sure that it does not have a rapid impact and it will gradually show you results. Keep expectations good but not quickly. As you file for additional credit accounts as needed, it may take several years to diversify your credit mix.

5. Minimize usage of New Credit Applications

New credit applications can be used if genuinely needed but better to avoid as much as possible. Use less because these impact 10% of your credit scores due to strict scrutinization, hence apply for credit only when necessary. Also, prequalification for loans to avoid hard pulls could keep you safe.

6. Dispute Inaccurate Information on Your Credit Report

Sometimes you could be a good performer but still have incorrect information on your credit report, or you can also be the victim of identity theft. But you are the one who has to resolve this all out. Dispute any errors, including fraudulent accounts, with the credit bureaus. Disputes typically resolve within 30 days.

7. Authorization

Being added as an authorized user on someone else’s credit card can boost your score, especially if the account has a positive history. The impact is usually seen within 1-2 months after being added.

Authorization always keeps you safe, and existent with a positive impact. If you are added as an authorized user on someone’s credit card, it could rapidly grow your score, especially if the account has a positive history. This impact is usually observed within 1 to 2 months.

8. Best Credit card for points

Selecting the best credit card for points can be a wise choice if you want to maximize rewards and raise your credit scores. These cards offer significant advantages including accruing points for regular purchases that may be exchanged for cashback, vacation, or other incentives, in addition to aiding in the development of your credit history. Over time, using such a card responsibly can raise your credit score.

Keeping the question in mind how to boost credit scores? Here’s pro tip

Pro Tip: Pay your bills on time and keep your credit utilization below 30% of your credit limit. Regularly check your credit score report for errors and dispute any inaccuracies to maintain a healthy credit score.

Conclusion

Credit score defines your creditworthiness and, hence plays a significant role in your financial progress. Hence implementing different explained methods is the best way to build credit because it can impact positively on your credit scores and negligence can negatively impact which could lead to negative effects on your financial life or wealth management.