Investment is an essential aspect of financial planning, and understanding the pros and cons of various available options will lead you toward informed and impactful decisions. Mutual fund remain one of the most famous and adjustable options for investors. Still, the question arises: How do they evaluate other investment options such as assets, equities, ETFs, fixed deposits, ULIPs, and more? This blog provides a detailed discussion to decide what works best for your financial stability growth, and objectives in the year 2025.

Why Choose Mutual Funds?

Mutual Fund pool money from different kinds of investors to invest in different kinds of portfolios of stocks, bonds, or other capital market products. They are professionally organized and operated and offer you a wide range of investment plans like systematic investment plans (SIPS). The best mutual funds balance expansion and security and bring about prosperity and resilience.

In 2025, mutual funds will continue to grow and shine because of their ability to meet diversified financial objectives and needs. Mutual fund provide tailored solutions if you’re in search of profit generation, tax savings, and consistent revenues.

Their professional coordination and strategies ensure that you are guided by market expertise and research that will eventually support a range of financial aspirations.

Mutual Funds Vs Stocks

If we compare mutual funds vs. stocks, the main difference lies in risk and commitments. Stocks usually allow direct possession in companies and corporations and generate higher growth and stability. Still, they demand activeness and knowledge about the market. Coverlets if we consider mutual funds. They offer wide options that include access to capital, diversification, risk management, and increased market efficiency.

Let’s take an example to understand the better way: Investing in the best mutual fund, like large-cap growth funds, stable growth investment portfolios, and the Vanguard Total Stock Market index fund, provides spread investments across various companies that will surely lead towards success without the need for constant monitoring. Stocks could be optimal for experienced investors willing to face the risk for potentially massive rewards.

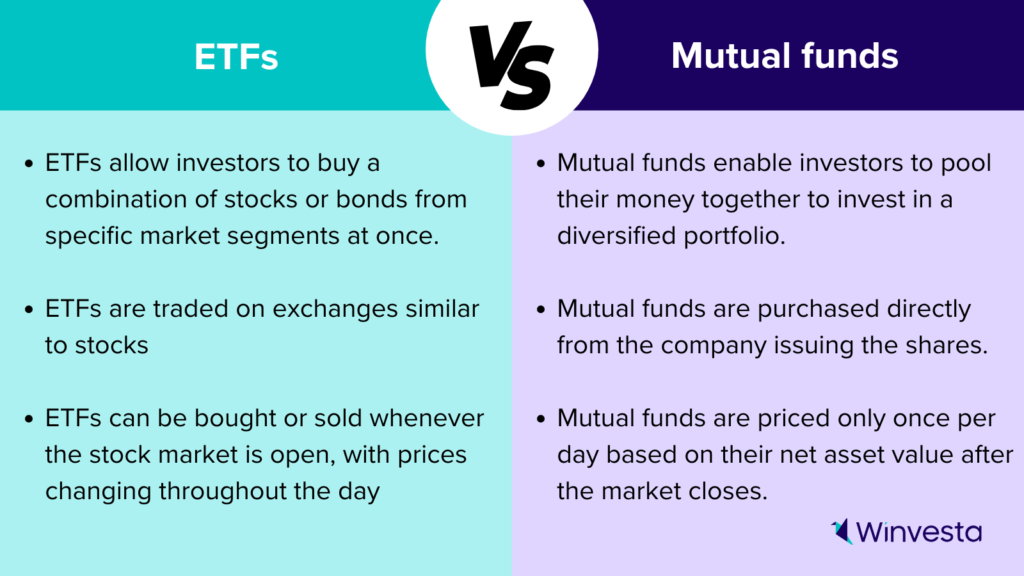

Mutual Funds Vs ETFs

Mutual fund actually mean taking money from various investors and putting this money in various assets like stocks, bonds or other capital-generating products. Mutual funds offer multiple benefits, out of which the most discussed are SIPs and maximum revenue generation. You simply put money in, and others professionally handle the rest of the matters. On the other hand, ETFs are basically like trading. ETFs often have lower expense ratios and are an incredible way to spread out your investments and mitigate risk factors.

If you’re looking for long-term investment plans with core contributions and essential funding, mutual funds could be the best option. For example, the best mutual funds in the year 2025 mainly focus on maximum capital generation, stability, growth or blended investment strategies, which are very suitable for consistent yields and sustained performances.

Mutual funds vs. fixed Deposits

Fixed deposits are low-risk investments that are exposed to the guaranteed return after a certain period. When comparing mutual funds vs fixed deposits, the main difference is the development prospects. Fixed deposits are appropriate for those investors who are conservative and seeking stability. In contrast, mutual funds provide you with multiple amenities and higher returns over a long period.

The best mutual fund often typically yield more than fixed deposits, especially equity-focused funds like Fidelity’s large-cap growth index Fund, which often spark. However, investors who prioritize safety over profit generation always prioritize fixed deposits.

SIP Vs Mutual Funds

A systematic investment plan (SIP) is a way to invest in mutual funds as a distinctive investment choice. SIPs give investors access to contribute small chunks regularly to their chosen mutual fund. This is best for those who want to build wealth and prosperity without getting disturbed by market timings.

Let’s understand this perspective in-depth by this example: Investing in the best mutual fund through SIPs promotes a steady approach and disciplined investment strategy and mitigates market fluctuations. SIPs have always been a preferred route for investors aiming to be financially settled without heavy portions of investment.

Mutual Funds Vs ULIPs

Unit-linked insurance plans (ULIPs) are the combination of investment with insurance coverage. When evaluating mutual funds vs ULIPs, mutual fund generally provide better returns due to lower costs and higher clarity. ULIPs may be appealing to those looking for the advantages of insurance and investment, but they frequently involve greater expenditure.

The best mutual funds concentrate mainly on heavy returns through expanded portfolios without giving the advantage of insurance complements for investors looking for simple investment strategies in the year 2025. Mutual funds are going to be the best option for catering to all sorts of investors.

ETF VS Index Funds

ETFs and index funds are the investment options that monitor a particular market index, like the S&P 500. They allow investors to invest in a massive variety of assets like bonds or stocks with an individual investment. When we compare ETFs and index funds, ETFs provide clarity on tax efficiency as they are more tax efficient compared to mutual funds and provide prominence in the fund’s composition. In contrast, index funds proceed as conventional mutual funds with daily settlement prices.

For long-term investors looking for low-cost exposure to stock market benchmarks, index funds such as the Shelton Nasdaq-100 Index Investor Fund are the extremely suitable choice among the best mutual fund currently present in 2025. ETFs may be suitable for those traders who prefer marketability and instant trading.

Why invest in mutual funds in 2025?

The year 2025 offers exciting possibilities and potential growth areas for mutual fund investors due to the advantageous economic circumstances and powerful market growth. The best mutual funds are being organized by professionals while generating the utmost revenues to support you.

For instance,

- Equity-focused mutual funds increase clarity the most; diversification and tax efficiency generate the maximum potential growth and stability.

- Combine equity, debt, and other assets to balance the risks and maximize revenue generation.

- SIP enables persistent contributions and long-term stability and steadiness.

Mutual funds also offer strategic plans to reduce all the burdens of tax-paying, which will ultimately lead to wealth creation.

Conclusion

Choosing between mutual fund and other investment options entirely depends upon your financial condition, circumstances to bear risk, and investment horizon. If we talk about stocks, they give the maximum yields, but risk factors are too high. In contrast, fixed deposits provide low yields but with no risks, particularly for stereotyped investors. ETFs are resilient, but active management is not required as much as for mutual funds. ULIPs provide a combination of both investment and insurance but come at a higher cost.

In the year 2025, putting your money in the best mutual funds is one of the most reliable and efficient methods for wealth generation while managing both the risk and the reward factors. Whether you’re looking for equity-focused options or hybrid schemes, mutual fund are best to be selected due to their regulation by professionals and diversification.

By reviewing this blog, you can easily understand the difference between mutual funds vs stocks, mutual funds vs ETFs, mutual funds vs fixed deposits, SIPs vs mutual funds, mutual fund vs. ULIPs. With ETFs vs. index funds, you can easily make a decision that fulfills your demands and needs.

2 Comments