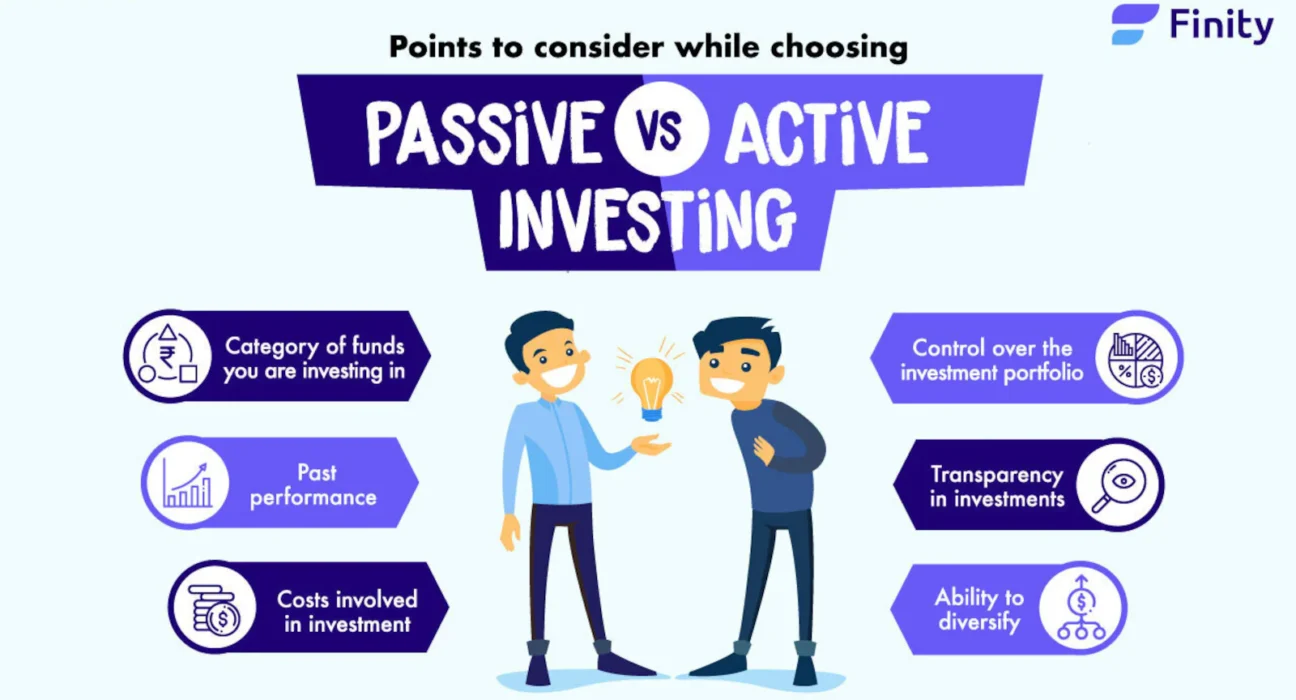

In the ever-evolving fixed income market, investors this year are still torn between picking active funds or passive bond funds. Both types of investing have their own strengths and weaknesses, so becoming familiar with their differences is important.

Understanding Active and Passive Bond Funds

The portfolios of active bond funds are run by pros who work to buy or sell bonds in response to potential opportunities in the financial markets and to adjust to the current economic climate. Unlike actively managed bond funds, passive bond funds closely follow the results of a certain bond index and usually charge smaller fees.

Bond Fund Performance in 2025

The data shows that lately, actively managed bond funds have been able to outperform bond index funds. Beating index funds is often hard for stock funds, but active bond funds have often succeeded in this. The fact is, approximately 64% to 80% of active bond funds have done better than passive funds over considerable periods, such as 10 and 15 years. Much of this trend occurs because of the complexities and disparities in the bond market that allow experienced managers to achieve impressive results.

When compared to the stock market, the bond market tends to be less efficient, and prices are not always right for each bond relative to its risks and rewards. They use analysis of credit ratings, reviews of different interest rates, and observation of bonds’ expiration dates to find securities that are less expensive than they should be and avoid those that cost more than they are worth. Since active funds can change as interest rates and credit vary, they are more resilient than passive ones, which cannot respond to changes because they are required to match the index.

Active vs Passive Investing: Key Differences in Fixed Income Funds

- Advantages of Active Bond Funds

Being actively managed, these funds offer different benefits. Managers can choose to keep debt for a shorter or longer period depending on the risk they wish to take. Active fund managers could control their risk by lessening the average term of their bonds in response to rising interest rates, while the bonds in passive funds simply mirror those of the index. Furthermore, these funds have the option to purchase high-yield or debt from foreign countries to benefit from additional opportunities.

- Benefits of Passive Bond Funds

Alternatively, passive bond funds are considered simple, straightforward, and less expensive than active bond funds. They mainly keep track of indexes like the Bloomberg U.S. Aggregate Bond Index, which mainly holds investment-grade bonds. If you are looking for bond funds that always have stable exposure to the bond market, it can be easy and cost-effective to choose passive funds.

Bond Market Strategies and Investment Strategies for 2025

This year, factors such as changing interest rates and credit changes are still impacting the market for fixed income. Being able to change the bond fund’s risk exposure can be very useful when interest rates are volatile. Core-plus bond strategies combine investment-grade assets with a few high-yield bonds or securities from countries other than the U.S. Their purpose is to generate greater returns than usual for bond funds, but they do it by acting more proactively.

Ladies who are interested in investing in bonds should keep their investment goals, how sensitive they are to risk, and the expense involved in mind. Anyone aiming for low-cost exposure and a large audience could pick passive, whereas someone less risk-averse and hoping to gain more from their investments in the bond market may choose active funds.

Conclusion

In 2025, people need to consider whether it is worth paying more for a chance at a better performance. In the past, active bond funds performed better than other types of bond funds by making use of available opportunities and aligning with different interest rate trends. They have the liberty to manage their risk and find increased profits, especially in today’s challenging bond market.

Still, those who seek an inexpensive, straightforward, and consistent way to invest in the bond market, mostly through core bond funds, should consider passive bond funds. A mix of active and passive funds may help many investors ensure their portfolio has the best combination of risks and returns.

The best bond funds to choose in 2025 will depend on how much investors understand the differences between active and passive investing in fixed income and align their strategies with what they hope to achieve.