Financial security and success are literally an achievement and a blessing, but their bedrock is financial planning. Whether you plan to build a dream home, plan for retirement, or wish to live a debt-free life, a good financial plan will set a roadmap for you. Let’s explore the definition of financial planning, its significance, and how to develop a strategy that aligns with your financial goals.

Financial planning helps you identify your miniature and mega financial goals and create a suitable plan to meet those goals. It is actually an evaluation of where you stand financially, where you are headed in terms of wealth and financial strength, and what plans and strategies could be the catalyst for your progress. Financial planning requires not only techniques or strategies but also discipline, patience, and dedication, which could imply impressive wealth management guaranteeing your financial progress.

Steps to Effective Financial Planning

Below defined steps are also impactful financial planning tips and a roadmap of financial planning for beginners as well.

Assess Your Current Financial Situation

As discussed, firstly it includes spotting where you stand by evaluating your income, expenses, savings, and debts. A comprehensive image of your current situation can be obtained using tools like smart budgeting applications or a net worth calculator. This stage is crucial to monthly budgeting because it allows you to evaluate how effectively you can now meet your needs and desires. You need to analyze how well you can cater to your needs and wants currently, what to eliminate and what to keep in your expenses, and where to spend strategically that may yield fruitful returns.

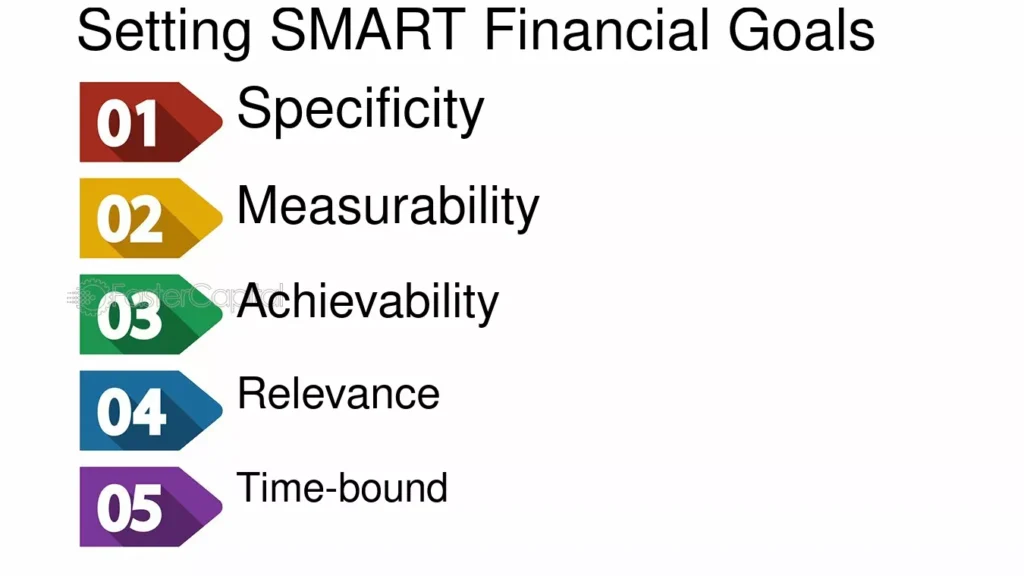

Set SMART Goals

You must think smartly to progress financially and deal with challenges in this era of inflation. You can think insightfully and create smart goals of your own, but some beneficial ones are suggested below.

- Be specific, Set a clear goal of what you want to achieve (e.g., Implement best saving strategies, save a huge amount as per your financial capacity for a down payment).

- Quantify your goals to track progress.

- Ensure that the goals you set are achievable as per your financial capacity.

- The goals you set should not be irrelevant; they must align your priorities that satisfy your needs, then pleasures and a sense of existence.

- Break your financial goals into milestones. Track your progress regularly and set a timeline for each goal.

- Invest in simple multiple little businesses such as shops, medical stores, mini marts, street food stalls, and food courts as per your financial strength, interest, and knowledge.

Create a Budget

Divide your income between debt repayment, savings, discretionary spending, and necessities. The 50/30/20 rule can be a fantastic place to start:

- 50% for needs like rent and groceries.

- 30% for discretionary spending.

- 20% for debt repayment and savings.

While creating and executing a budget, you must not forget the implementation of techniques that could save you money.

Establish an Emergency Fund

Aim to save three to six months’ worth of living expenses in a liquid, easily accessible account. This fund is going to act as a financial rescue element for you, it will play a vital role in carrying you in case of unexpected emergencies such as job loss or medical emergencies. The importance of setting up an emergency fund is often realized when an emergency occurs and one doesn’t have it, then borrowing money is needed, which results in debt. It’s better to be prepared to feel secure financially. Effective money management helps you avoid this situation, as it’s always better to be prepared and feel secure financially.

Invest Wisely

Examine your investment options in light of your financial objectives and risk tolerance. To reduce risks, diversify your holdings by adding equities, bonds, mutual funds, and real estate. Invest in the type of investment that you understand deeply well and can also counter or bear with its demerits.

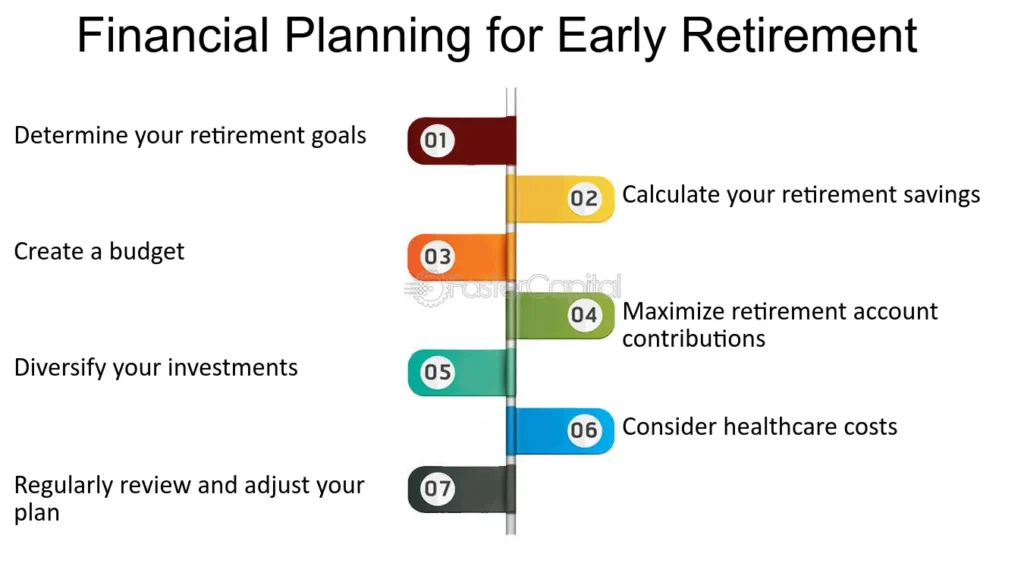

Plan for Retirement

Strategize earlier for post-retirement tenure too while making financial plans. Start early to take advantage of compound interest. Contribute regularly to retirement accounts like a 401(k), IRA, or pension plan. You can also invest in real estate; this will typically be the one-time major investment that could result in financial safety and comfort after retirement. Consult a retirement financial planner to determine how much you need to save based on your retirement lifestyle.

Paying Off Debt Pay off debt from time to time. As generally suggested above, 20% is at least of the amount you should keep to manage debts. Pay off within the deadlines to avoid any interest.

Overview

Financial planning is not just a technique or strategy; rather, it is an oath for the greatness of your financial future. By assessing your financial position and setting meaningful financial goals that align with your ambitions, creating a disciplined budget, and tackling emergencies, you lay a strong foundation for your financial freedom. Make sure that discipline, perseverance, and consistency are necessary for effective financial planning. Begin now, maintain your focus, and welcome the path to reaching your financial objectives and leading a financially secure life.