A key linchpin of financial planning and analysis is saving money. Developing effective saving practices is a significant step toward economic independence, regardless of your goals—to secure your future, prepare for a specific purchase, or just find peace of mind. We’ll look at useful savings advice,ways to save money, resources, and effective money saving tips in this guide to help you save more efficiently. We’ll cover everything you need to know to get started, from budgeting tips to the best ways to save money fast.

Why Saving Money is Important?

Saving money is not only about saving a part or piece of your income. It is a must needed ambition for true budgeting and money management. From buying a specific purchase to looking for the best way to save for a house, from tackling emergencies to the conversion of dreams into realities, it’s a much-needed anchor for achieving financial goals.

5 Insightful Creative Saving Advices

Below advices are perceptive money tips

- Do It Yourself

By removing the need for costly store-bought goods or expert services, do-it-yourself projects can drastically reduce expenses. Here are some ideas for integrating do-it-yourself into your life:

- Home Repairs: For all the repairs needed at your home, you should be self-made and creative for that.

- Decorations and Gifts: Handmade presents, like picture albums or knit scarves, are economical and considerate.

- Gardening: Producing your flowers, veggies, or herbs cuts shopping expenses and amplifies the aesthetics of your area with a natural vibe instead of spending so much for luxurious and lavish architecture.

- Shop Secondhand

Buying secondhand goods is an economically responsible way to receive high-quality products at a significantly reduced price and is the best way to budget money.

- Clothes: Even the high-end brands’ gently used or even brand-new clothing is frequently available at great prices at thrift and consignment stores, you can look for them.

- Furniture & Home Goods: There are some marketplaces that offer reasonably priced appliances, furniture, and decoration pieces.

- Electronics: Smartphones and laptops that are gently and carefully used, can be bought at far less and negotiable prices.

- Get Efficient Light Bulbs

This can be a fair money saving plan because LED lights are affordable, long-lasting, and energy-efficient, they are an impressive alternative to conventional incandescent light bulbs and are quickly becoming a home essential. Compared to traditional bulbs, upgrading to LED lighting may cost more upfront, but actually result in long-term savings.

- Sell Unused items

Sell out items which lie on tables only and are rarely used. It could be appliances, machines, etc., or other accessories. It would be the best saving plan to sell those out. Selling these things can be a terrific method to get more money.

- Staycation

People are often seen going to restaurants on weekends, tripping abroad, and adventurous places during holidays with poor money management. Such things are also an element for refreshment and mental well-being. But one can follow staycation as well up to 70-80% of the time. Instead of that one can arrange meetups and gatherings with family, relatives, or friends at home. Cooking special meals at home will still cost much less than in restaurants and fancy cafes. It will also be saving accommodation and conveyance expenses.

Pro tip: Set up an automatic transfer to your savings account, which would be the best place to save money right after you get paid. This way, you save first before spending. This is the best way to save money

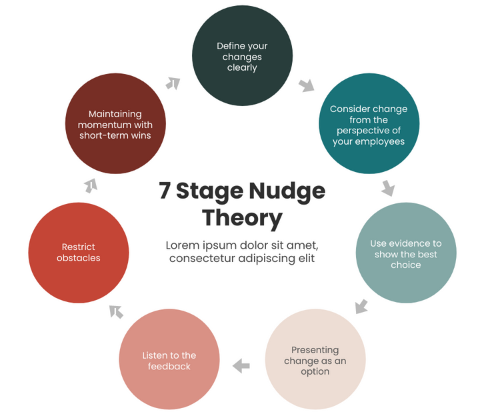

Nudge Theory:

In psychology and economics, nudge theory—also referred to as behavioral economics—tries to change people’s behavior and choices by using indirect suggestions and subtly positive reinforcement as opposed to coercion or direct teaching.

According to the notion, minor nudges, including altering the presentation of options or rephrasing the message, can significantly influence people’s decisions. Nudges can be used to encourage desirable results including financial responsibility, environmental preservation, and healthier behaviors.

Nudge theory effect in saving money?

Consider an example, if some of your friends consume so much junk food and are facing money-saving issues. What else can you advise them? Eat homemade food and save money? But there’s another way of conveying a message. Care for your health and fitness in order to avoid medical challenges in the future. Thaler and Sunstein describe a nudge as:

‘’Any aspect of the choice architecture that alters people’s behavior in a predictable way without forbidding any options or significantly changing their economic incentives. To count as a mere nudge, the intervention must be easy and cheap to avoid. Nudges are not mandates. Putting the fruit at eye level counts as a nudge. Banning junk food does not.’’

Conclusion

Saving money is a fundamental pillar of financial planning and analysis, enabling individuals to achieve financial freedom and meet their financial goals effectively. By incorporating strategies like DIY practices, secondhand shopping, and staycations, alongside behavioral insights like nudge theory, you can maximize savings while fostering responsible money management. Seeking guidance from certified financial advisors can further streamline your journey toward comprehensive financial management and long-term security.