The way to build wealth and attain financial stability for the future is by investing wisely. There are so many investment strategies to follow that it becomes difficult to pick the one that suits your financial needs. Explore whether you need to pick diversified funds or if you’re a seasoned investor and which method would work in your particular case. To support long-term growth, it is important to make informed decisions to get maximum returns with the minimum risk.

Understanding Investment Strategies

If you want to grow your wealth over time, then investment strategies are important. By providing a structured framework for handling money, these products assist investors in balancing risk and reward. The best investment strategies are all about diversification, patience, and smart asset allocation. By choosing the best blend of investments, you minimize market volatility while maximizing your growth.

A very popular form of stock market investments. Long-term investors have always preferred to invest in high returns from the stock market in the long run. Before investing, though, it is necessary to evaluate market trends, the economic situation, and the conditions of the company. It can help you understand stock trading fundamentals and make the right decision to avoid risks.

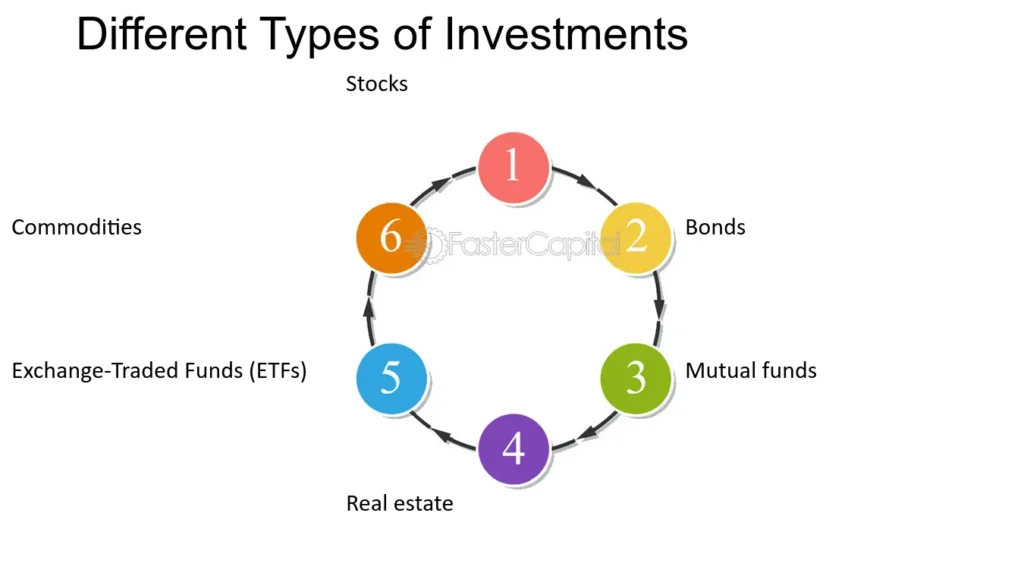

Exploring Different Types of Investments

For long-term growth, you need to diversify your portfolio by trying some other types of investment. Diversification mitigates risks and leads to steady returns despite underperformance of some of the asset classes. Some of the best investment options are stocks, bonds, mutual funds, real estate investment, and alternative investments.

Another long-term growth strategy is real estate investment. Rental income or capital appreciation from properties that you buy can deliver a good return over time. Real estate is stable and a hedge against inflation, does not pay dividends, and is a great way to build wealth steadily.

Another good way to get some long-term returns on investment is through investing in small businesses. A lot of entrepreneurs look for investors to fund their business, giving them equity or their profit arrangement. Small businesses that achieve rapid growth and expansion can offer substantial returns to those supporting their businesses.

Key Investment Strategies for Long-Term Growth

- Buy and Hold Strategy—it is a strategy of buying assets and holding them for the long term. This enables investments to grow even if there are ups and downs in the short-term market.

- Diversification—With diversification, investments are spread across different investment classes (stocks, bonds, and realty) to reduce risk and secure consistent returns as well.

- Growth Investing—This involves investing in companies with tremendous growth potential, usually in developing industries that include technology and healthcare.

4. Dividend Investing—Investing in stocks that pay dividends can earn you passive income and the appreciation value of your investment.

5. Real Estate Investment—Buying properties to generate rental income or appreciate over a long period can provide financial security and protect against inflation.

6. Index Fund Investing—Investing in a low-cost index fund that tracks the overall stock market performance is a passive and steady approach to long-term growth.

- Dollar-Cost Averaging—A strategy of investing the same amount every period, mitigating market volatility, and allowing for a secure accumulation of wealth.

Stock Market Investments and Risk Management

Stock market investments are crucial for long-term accumulation of wealth. The other way, which is more beneficial, is the high-quality stocks with good fundamentals, and investing in these will help you reap 10 times the amount in time to come. Yet, stock market volatility comes with inherent risks; thus, it is important to take a disciplined approach.

Asset allocation is one way to mitigate risk. It means splitting your investments over different classes of assets, including stocks, bonds, and real estate, to ensure risk and reward are in line. The goal of a well-diversified portfolio is to avoid large losses in any single area affecting overall returns.

Dollar cost averaging is another strategy that long-term investors should also consider; it is a means of investing a fixed amount at regular intervals. By this approach, market fluctuations have less influence and help smooth the investment growth over a period.

Choosing the Right Investment Strategies for You

When choosing investment strategies, you must take into account risk tolerance, investment goals, and investment time horizon. Low-risk options like bonds and mutual funds will be preferred by conservative investors, while aggressive investors can opt for stock trading and alternative investments.

It also includes keeping up to date on trends in the stock market and the state of the economy. Reviewing your portfolio regularly and adjusting your investment strategies with changing financial goals will ensure that you are on track for long-term growth.

Conclusion

When making the best investment strategies to grow over time, it is important to make decisions based on planning and diversification along with proper risk management to select the best investment strategies to realize high returns. No matter what type of stock market investments, real estate investments, or investments in small businesses you choose, a balanced portfolio is the key to financial success. Understanding market trends and taking your decisions logically helps you have steady growth and a bright hotel future.