In this era of an ever-changing business environment, it is not uncommon for businesses to encounter numerous uncertainties that affect their financial sustainability and overall stability. Pivotal’s ability to mitigate the possibility of threats and ensure consistent growth is adequate risk management. For small business owners or large corporations, having a well-laid-out risk management’ plan can protect your assets and keep your business safe in turbulent times.

Understanding Risk management and Its Importance

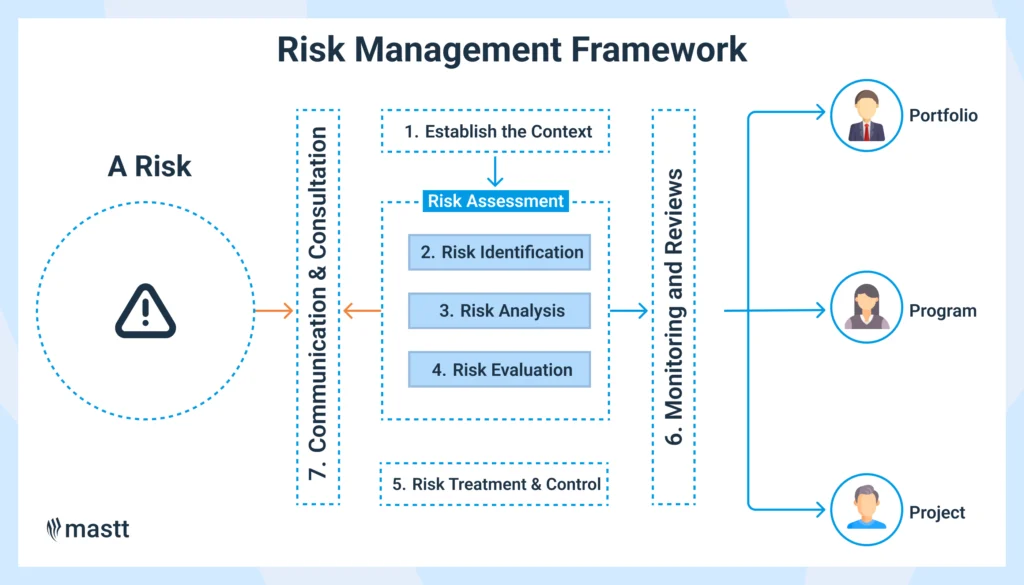

Before looking into the strategies, it is essential to understand the importance of risk management within the business operations. Every business takes a risk, which can be a financial, regulatory, market-based, or operational issue-related risk. An effective risk management system helps to detect, evaluate, and control these risks, providing an organization with preparedness for unpredictable events. In the absence of a good risk management process, companies could suffer financial losses, reputation losses, or, in extreme cases, legal problems.

Identifying and Assessing Business Risks

The initial step in risk management is to determine possible hazards. Companies must review positive and negative internal and external factors that could impact the business. Internal risks consist of financial mismanagement, employee mistakes, and operational inefficiencies, whereas external risks derive from the downfall of the economy, changes in regulating laws, and competition threats. They must be assessed once the probabilities of occurrence and impact are established.

Carrying out a proper risk assessment allows a business to pinpoint which risks are worthwhile to tackle first and which they can easily handle. This is where enterprise risk management (ERM) has the power to come to your rescue with a well-designed risk management plan.

Diversification as a Key Risk Management Strategy

One of the most useful methods of managing risk in respect of finances is diversification. Employers should not overly depend on those one or two clients’ revenues. Scaling up product catalogues, entering new territories, and diversifying into various revenue streams can mitigate financial risks. This strategy also ensures that if one revenue stream is reduced, others can make up for the reduction in potential revenue.

For investors and commercial banks, diversification in investment portfolios is one notable way of financial risk management. To minimize risk, spreading investments through various asset classes is advisable and will result in a more secure financial position.

Implementing a Strong Risk management system

A good risk management system has policies, procedures, and technology-based tools for assessing and managing risks efficiently. A lot of businesses implement risk management software to monitor real-time threats, ensure compliance with the government, and facilitate a process of decision-making.

Companies also need to set up an internal risk committee that will supervise the risk management activities. This team needs to primarily look into the occurrence of business risks, modernize operational policies, and launch necessary improvements to mitigate any threats.

Financial risk management Through Cash Flow Planning

A well-structured cash flow plan is a basic part of financial risk management. Businesses must store enough cash on hand to be able to cope with unexpected gratuities. Keeping track of expenses and shrinking unnecessary costs while having access to makeshift when unexpected expenses come up can help prevent financial instability.

Another important point is to be effective in managing your debt. High debt levels can lead to cash flow problems, particularly when the economy is experiencing a downturn. By maintaining a balanced relation of assets and liabilities, enterprises may minimize the risk of financial losses and increase long-term sustainability.

Compliance and Regulatory Risk Management

As requirements fluctuate under new laws and regulations, businesses need to keep up to speed on compliance responsibilities. Breaking the law could lead you to penalties, a disaster for your reputation, and loss of funds. A risk management process should be systematic and ongoing, including definite regular audits, professional legal advice, and employee compliance training.

For companies running in different jurisdictions, appreciating domestic statutes and international business laws is important. Implementing robust compliance measures allows businesses to run within all legal frameworks, therefore protecting themselves from potential unnecessary risks and liabilities.

Risk Management in Cybersecurity

In this digital era, cybercrime poses a serious threat to business. Data breaches, hacks, and identity theft can cause losses of revenue and harm the reputation of the company. Businesses should have good cybersecurity practices in place, including firewalls, encryption, multi-factor authentication, and regular security tests.

Employee training is also important in preventing cyber threats. Many security breaches result from human mistakes like opening phishing emails or using weak passwords. Employee training on cybersecurity best practices prevents data breaches and protects addressable firm assets and sensitive information.

Crisis Management and Business Continuity Planning

Regardless of how well-prepared a business may be, unexpected crises can still arise. The crisis management plan is a vital component of an effective risk management plan. Businesses need to plan for different eventualities like recession, supply chain disruption, or natural disasters.

A business continuity plan guarantees that the business will be operational even during emergencies. It may also include remote work policies, substitute suppliers’ insurance coverage for financial losses, or others. Crisis preparedness is strengthened while regular testing and updates of crisis response plans reduce potential disruptions.

Seeking Professional Guidance for Risk management

While companies can do their risk management, there can be added value to be gained from consulting professionals, as well as tailored and expert solutions. Working with risk management specialists or financial advisors enables businesses to spot blind spots and create tailored solutions.

Big corporations will typically deal with legal and financial companies that specialize in financial risk management. They offer advice on compliance, investment risk, and governance of business, ensuring business operations within a stable financial environment.

Conclusion

Risk is a fact of the life of a business, but effective risk management methodology can reduce financial and operational risk. Businesses can reach long-term stability by bringing to light the dangers, organizing a framework for the risk management system of a business, spreading their sources of income, and respecting regulations. Financial planning, cybersecurity, and building up crisis preparedness also make companies more resilient to uncertainty.

No matter how large the corporation is, every business should prioritize risk management to secure its future. By staying proactive and consulting with professionals, businesses can face challenges head-on with confidence and keep growing in an ever-changing market.