Today’s living requires debt, but different types of debt hold varying levels of value. Mastering financial control requires learning how to recognize the distinction between good debt and bad debt. Some types of debt serve as tools to achieve wealth creation and major life milestones, but bad debt leads to impaired financial situations. We will investigate the good debt vs. bad debt distinction in this content and demonstrate both types with examples, then present helpful methods to handle your money efficiently.

What Is Good Debt?

People use good debt, which involves borrowing funds to invest in assets that raise value and deliver future advantages. The debt type that focuses on personal growth and financial well-being transforms into an opportunity that serves your needs. Mortgages, student loans, business loans, and low-interest loans for home improvements are examples of good debt. Good debt strengthens your financial position because it produces investment returns. A student loan for a high-demand profession such as medicine or law appears burdensome at first but ultimately leads to future financial security and career development.

What Is Bad Debt?

Borrowing money to purchase assets that neither gain value nor create profit falls under the category of bad debt. High interest rates characterize this type of debt as it tends to create an uncontrollable financial situation when people fail to manage it properly. The most common examples of bad debt involve credit card payments, payday loans, and any money borrowed for personal spending needs. Bad debt develops due to hasty buying decisions or inadequate financial preparation. Refusing to take responsibility for this debt type is essential because it fails to benefit your financial standing.

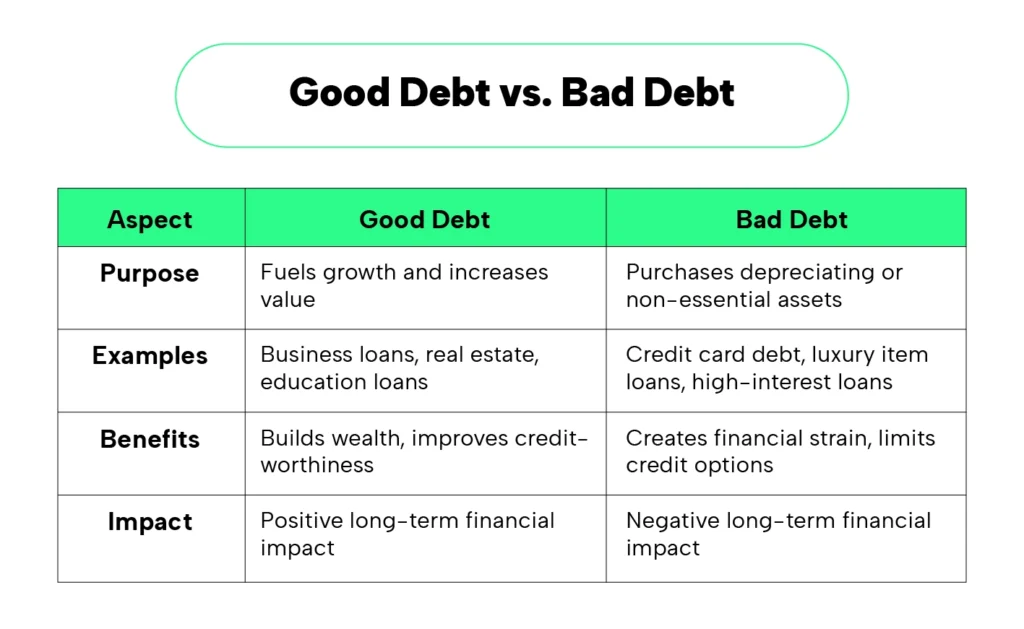

Good Debt vs Bad Debt: Key Differences

Your financial wellness depends on the differences between good debt and bad debt according to their effects. Good debt enables resource accumulation toward important targets, but bad debt depletes investment without providing noteworthy value growth. Equity growth from obtaining a mortgage to purchase a home results in homeownership becoming an asset. You will pay high-interest costs with no returns on your investment since you keep unneeded expenses on your credit cards. A clear understanding of good debt vs bad debt helps people make wise financial choices.

How to Manage Good Debt vs Bad Debt

To control your debts, you need to identify different forms of debt and implement strategic financial approaches. You should initialize your debt relief efforts by eliminating bad debt obligations. Paying debts starting with the ones that have the highest interest rates through the avalanche method grants you long-term financial savings. The advantage of good debt is that it cannot replace the need to stay within your financial means. The smart strategy when dealing with student loans includes using them only for essential educational expenses while also staying within your budget limits for mortgage payments.

You need to develop a budget system. Your realistic budget system enables you to eliminate bad debt while properly maintaining good debt obligations. Putting away savings for an emergency fund ensures you avoid using credit when faced with unexpected events. People with multiple debts should look into obtaining a single loan that carries lower interest rates for debt consolidation. The payment process becomes easier, and total expenses decrease when you consolidate your debts.

Avoid Accumulating New Bad Debt

The debt payment strategy requires debtors to stop using their available cash for unnecessary purchases and to only take new loans when needed. Focusing on eliminating bad debt becomes easier when you take steps to prevent additional financial pressure. To achieve better borrowing and spending decisions, establish guidelines between good debt vs bad debt types.

The Long-Term Impact of Good Debt vs Bad Debt

The way you approach your current debt will define how your financial situation looks in the future. Responsible payments of good debts such as residential mortgages and educational loans improve your credit score, which creates better access to advantageous interest rates and enhances borrowing capacity for future use. Debt that is registered as bad debt puts pressure on your money supply while reducing your ability to obtain credit if your payments are late or become delinquent. People who misuse credit cards end up stuck making only minimum payments, which cannot even cover their growing interest costs. Taking out a business loan and utilizing it properly results in the growth of a profitable business enterprise.

Final Thoughts

Everyone needs to know the difference between good debt vs bad debt when making financial decisions. Good debt serves as a useful tool that helps people reach their life goals through homeownership or professional development, but bad debt pulls money away from achieving important milestones. Before you achieve mastery in handling your money, you need to eliminate bad debt while using good debt as a tool for long-term gains. Create financial structures to fulfill your targets while reserving emergency funds first and learning how to manage expenses sensitively. Understanding what makes good debt and bad debt will lead you toward both financial resilience and enduring achievement. Your debt management approach determines the outcome more than simply having debt because you can effectively handle different types of debt. Knowing the difference between good and bad debt remains essential for maintaining financial stability while pursuing sustainable growth.