In the field of investing, which can sometimes be confusing, a long-term, goal-oriented strategy allows anyone to build their way to fiscal development. It becomes important to understand the investment strategies that would help determine the right investment plans, hence enhancing long-term performance. Whether you’re looking for low-risk investment ideas or you’re saving for the distant future, such as old age or retirement, this guide can be of help to you.

Smart Investment Ideas for Every Beginner

- Exploring Different Investment Options

The first thing you need to consider is the different sort of investment opportunities in the market. Therefore, for investment strategies, beginners should always consider the level of risks to be taken concerning the possible returns to be made. Stocks are easily the most basic form of investment for most people. There is growth in value over the long term in investing in established corporations and index funds. Another good investment type is the ETF; they let investors diversify to invest in positions without purchasing shares of individual stocks.

- Low-Risk Investment Opportunities

If you are seeking low-risk investment ideas, fixed income securities such as bonds and certificates of deposits offer the least risk. These assets have a lower potential for generating returns than stocks, but they are stable, and you can easily calculate their income. Also, it is very easy to diversify the portfolio with the help of mutual funds, which pool together many assets to minimize your risk.

- Small Investment Ideas with Big Potential

If you are looking for small investment ideas, one idea to try is micro-investment apps. These platforms enable you to invest coins or small funds regularly, which, in the process, helps in creating a good portfolio. Finally, more people can invest in properties using little capital through real estate crowdfunding platforms.

- Retirement Investment Strategies for Long-Term Growth

It is necessary to include retirement investment strategies as part of your long-term security planning. Saving into a 401(k) or an IRA is an effective method that guarantees steady earnings and more benefits from the provided tax advantage. They are useful for those who consciously seek the best investment ideas that will provide for the future or for those who want to earn more income with compound interest.

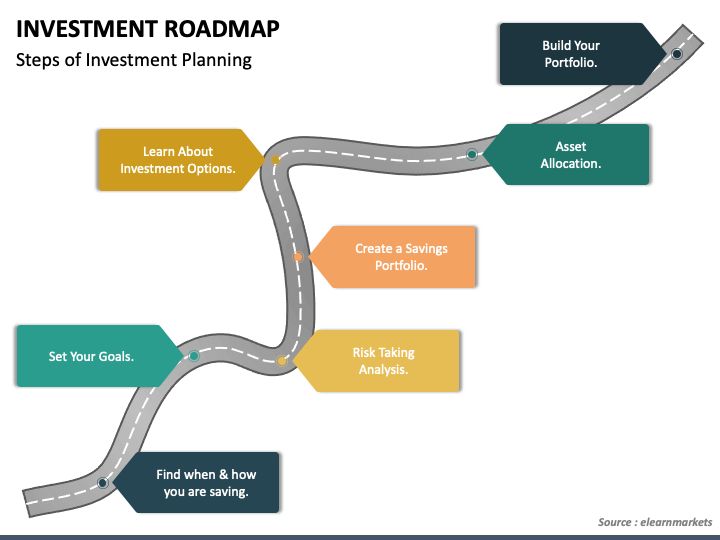

Where to Start – Building Your Investment Roadmap

- Defining Your Financial Goals

You must approach the investment arena with knowledge of your financial objectives and your ability to endure some level of risk. The first thing when selecting the goals is to understand and know what you want to achieve. Are your savings intended for retirement, a one big buy or for being able to achieve financial freedom or independence? Setting clear goals helps shape your investment strategies and ensures you stay focused.

- Educating Yourself on Investment Strategies

Generally, to invest, it is good to familiarize yourself with various investment types. It is fairly easy to find various tutorials, books, articles, and courses that teach the object of investing from scratch. The knowledge about the assets that make up the portfolio and the market trends and strategies of risk management will help make better decisions. Another source of information is a financial advisor, who can give individual advice concerning the client’s or company’s financial activity.

- Choosing the Right Investment Platform

Another important decision is securing the right platform to invest in. Open online brokerage accounts, robo-advisors, and investment applications help the novice to get into the game. One such tool would be robo-advisors, which are ideal for auto-investment based on a customer’s risk tolerance level. They offer diversified portfolios that one does not have to be involved in managing physically, thus being one of the best investment strategies for beginners.

- Starting Small and Staying Consistent

In fact, the basic rule that can be stated is perhaps to start small at first. This shows that it is better to invest a little each time rather than wait for the perfect time to invest. This is the principle of compounding, which is the ability to increase value over time by making daily contributions. Moreover, diversification prevents over-concentration of your funds in a particular asset type and enhances the overall stability.

How to Succeed – Mastering the Art of Investing

- Staying Patient and Disciplined

The principles of investment also entail time, and it is an essential characteristic of investing that cannot be overemphasized. The best thing is to keep this approach constant and eliminate the factor of emotion within this investment strategy. The stock market involves a lot of risks, but focusing on long-term returns instead of short-term returns is a wealth-creating strategy.

- The Importance of Diversification

Risk diversification measures are very important when it comes to the risk management process. Investors are at risk when investing in a single type of investment, and that is why it is encouraged to diversify the investment portfolio and expand it to stocks, bonds, houses, and mutual funds. This way, there’s a minimized chance of incurring a loss, and they also maximize profitability chances at the same time.

- Keeping Up with Market Trends

Market trends must also be analyzed, and there are times when strategies have to be changed in some way. The funds, as well as interest rates, political conflicts, and general economic state, also can influence the investments; thus, it is critical to be aware of them always. This helps to regularly update the portfolio based on market conditions and risks that you as an investor are willing to take on and any other considerations that you as the investor may want to achieve.

- Avoiding Common Investment Mistakes

The other crucial factor when it comes to investing is a negative aspect commonly referred to as mistakes. Pride, greed, fear, impulse, and failure to diversify are dangers of investing that result in losses. However, being disciplined and adherent to laid-down investment strategies will be more productive in the long run.

Long-Term Strategies for Financial Success

It is imperative for those who are seeking the best investment strategies to think long-term instead of seeking to make quick and hefty profits. Regular investing, where a set amount is invested in the market at least once a week, also moderates the risk in the market. Another advantage of dividends is that reinvestment also helps in wealth accumulation; indeed, it is one of the most effective investment strategies for beginners and novices.

So, anyone who wants to build their financial reserves by investing must be prepared to wait for a considerable time before achieving the desired results. Therefore, beginners have to be creative in their investment ideas when it comes to investments, ensure that they start with the right plan, and apply the right methods that will guarantee their success in the future. When it comes to investing, either for the short term or for the long term, always watch the markets and be consistent in your investments.

1 Comment